Sep. 30, 2022

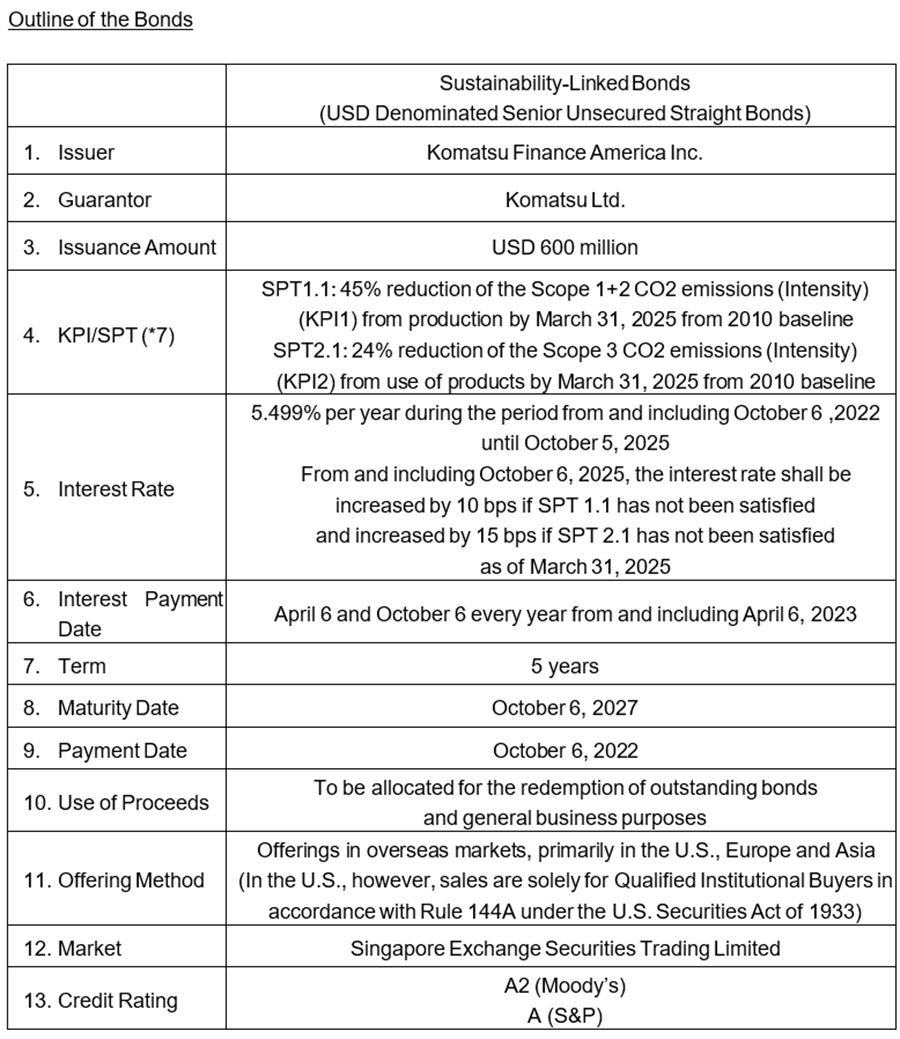

Komatsu Ltd. (President and CEO: Hiroyuki Ogawa) (hereafter “Komatsu”) decided on September 29, 2022, to issue Sustainability-Linked Bonds (USD-Denominated Senior Unsecured Straight Bonds) (hereafter “SLBs”) through Komatsu Finance America Inc., Komatsu’s wholly-owned subsidiary. (*1)

SLBs are bonds the terms and condition of which are subject to changes depending on the achievement status of the KPIs predetermined by the issuer. Under Komatsu’s three-year mid-term management plan to be completed in the fiscal year ending March 31, 2025, “DANTOTSU Value - Together, to ‘The Next’ for sustainable growth”, Komatsu aims to create customer value that will contribute to ESG solutions and earnings growth through its growth strategies and intends to accelerate sustainability management targeting achievement of sustainable growth by this issuance of SLBs. (*2)

Under the mid-term management plan, Komatsu has set a target of reducing its carbon emissions by 2030 to 50% of its carbon emissions in 2010 and aims to achieve carbon neutrality by 2050 as a challenge target. Komatsu aims to contribute to the reduction of CO2 emissions all over the society not only in Komatsu’s own sites and during operation of its own production facilities but also in Komatsu’s customers’ sites, by optimizing operational processes. Accordingly, Komatsu determined the following two KPIs for this SLB.

KPI1: CO2 emissions from production (CO2 emission intensity) (*3)

KPI2: CO2 emissions from use of product use (CO2 emission intensity) (*4)

For details, please refer to Komatsu’s Sustainability-Linked Bond Framework. (*5)

Komatsu’s Sustainability-Linked Bond Framework has obtained a second party opinion from DNV BUSINESS ASSURANCE JAPAN, K.K., an internationally recognized organization with expertise in this field, concerning its conformity with the Sustainability-Linked Bond Principles 2020 of the International Capital Market Association (ICMA). (*6)

*1: Guaranteed by Komatsu

*2: KPI:

Key performance indicators

*3: The CO2 emissions per production value

*4: The CO2 emissions per work volume

*5: For the details of Komatsu’s Sustainability-Linked Bond Framework, please refer to:

Sustainability-Linked Bond Framework

*6: For the details of the second party opinion, please refer to:

Second party opinion

*7 SPT:

Sustainability performance targets, which are measurable target figures of KPIs over the specific time period as stated by the issuer

This press release has been prepared for public announcement for the issuance of USD-denominated senior unsecured straight bonds by Komatsu Finance America Inc. and does not constitute an offering of securities in the U.S. and has not been prepared for the purpose of soliciting investments. The bonds have not been filed or registered under the Financial Instruments and Exchange Act or applicable securities laws of Japan or any other jurisdiction and may not be offered or sold when the filing or registration of the bonds is required under such laws, unless such filing or registration is made or an exemption from such filing or registration applies. The bonds have not been or will not be registered under the U.S. Securities Act of 1933 and may not be offered or sold in the U.S. unless a registration is made under the U.S. Securities Act of 1933 or an exemption from the registration requirement applies.

No : 0050(3170)

Corporate Communications Department

Sustainability Promotion Division

Komatsu Ltd.

tel: +81-(0)3-5561-2616

mail: JP00MB_cc_department@global.komatsu

*The information may be subject to change without notice.